29 Jun 2023

The Greek Wire - June 2023

The Greek Wire is a monthly newsletter aiming to inform you about key economic and political developments in Greece.

Greek elections 2023: Strong New Democracy victory - New Greek PM vows to press ahead with ambitious reforms

Greek voters re-elected the conservative New Democracy party, setting the stage for its leader, Kyriakos Mitsotakis, to strengthen his grip on power with an absolute majority and what he called a “strong mandate” for the foreseeable future.

As per Kathimerini article “Success story” seen continuing Markets expect more economic recovery and a return to investment grade after the elections.

The continuation of the economic recovery and Greece’s return to investment grade after almost 13 years is what markets expect after the elections.

The impressive performances of the Athens Stock Exchange and Greek bonds since the beginning of the year, and especially since the first election, show that investors consider Greece a success story, but that depends on political stability and the existence of a strong government that will follow the pro-reform and pro-investment policies that have led the country to outperform most other eurozone economies.

Read the full article of Kathimerini in the following link:

https://www.ekathimerini.com/economy/1214015/success-story-seen-continuing/

Greek House Davos setting the agenda of January 2024 : The meetings that took place in Davos January 2023 between international groups, business leaders and Government officials, the private dinners and the business friendly environment that were formed.

The Greek House accomplished all its goals in January 2023. Its events have seen major deals being struck, new business avenues opened and powerful groups brought into contact. Over the years, Greek House Davos has successfully facilitated valuable communications between giant companies through its organization. For example, in previous events, groups of companies such as Boston Consulting Group, Carlyle Group, J. Safra Sarasin Private Bank, Lombard Odier Bank, Banco Bradesco, Mubadala Investment Company, Investcorp, Artoc Group, Gulfstream, Hyundai, SK Group, APM TERMINALS - A.P. Møller - Mærsk A/S, Saudi Aramco, EMI, State Oil Fund of Azerbaijan, Nielsen, Cargill, Shell Global, Glencore, Repsol, Naturgy, Trafigura, Vale SA, Chevron, the BHP Group, Palantir, Manchester United F.C., as well as many government officials and international bodies from a range of countries such as the Minister of Housing, Urban Affairs & Petroleum and Natural Gas of the Government of India Hardeep Singh Puri, the Secretary General of the Ministry of Innovation India's Anurag Jain, Indonesia's Deputy Finance Minister Amalia Adininggar Widyasanti, Panama's Investment Minister José Alejandro Rojas and Saudi Arabia's Investment Minister Khalid Al-Falih, as well as Munich Security Conference Vice President Dr. Benedikt Franke gathered, highlighting the organization's commitment to drive positive change and promote effective partnerships on a global scale.

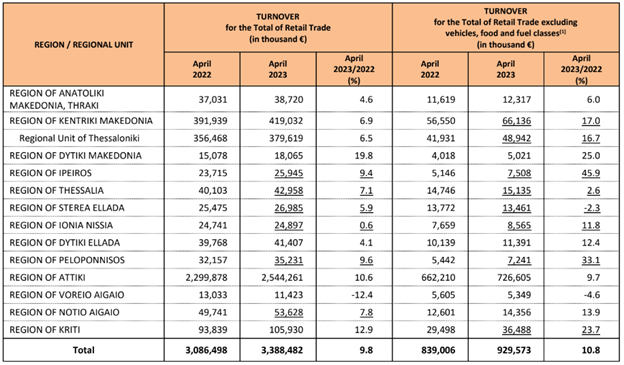

Retail: Turnover increase of 9.8% in April

For the enterprises in retail trade divisions obliged to double-entry accounting bookkeeping, for which data are available on a monthly basis, the turnover in April 2023 amounted to 3.39 billion euro, recording an increase of 9.8% in comparison with April 2022, when the respective turnover was 3.09 billion euro and a decrease of 1.2% in comparison with March 2023, when the respective turnover was 3.43 billion euro. The activities that recorded the biggest increase in turnover in April 2023 compared with April 2022 are: Retail sale of second-hand goods in stores, increase 195.5% and retail sale of music and video recordings in specialized stores, increase 38.8%. The activities that recorded the biggest decrease in turnover in April 2023 compared with April 2022 is: Retail sale of carpets, rugs, wall and floor coverings in specialized stores, decrease 35.7% and retail sale via mail order houses or via Internet, decrease 10.2%.

Source: Hellenic Statistical Authority (ELSTAT)

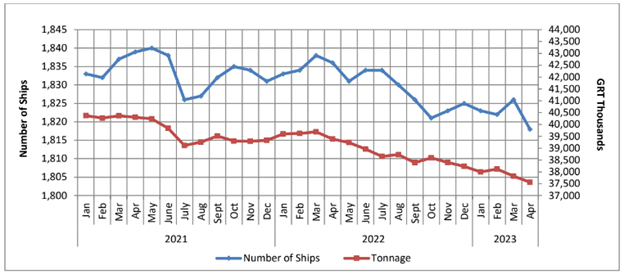

“Stormy” 2023 for the Greek Merchant Fleet

The Greek Merchant Fleet decreased by 1.0% in April 2023 compared with April 2022. A decrease of 0.2% was recorded in April 2022 compared with April 2021. The gross tonnage of the Greek Merchant Fleet, for vessels of 100 GRT and over, recorded a decrease of 4.6% in April 2023 compared with April 2022. A decrease of 2.3% was recorded in April 2022 compared with April 2021.

Source: Hellenic Statistical Authority (ELSTAT)

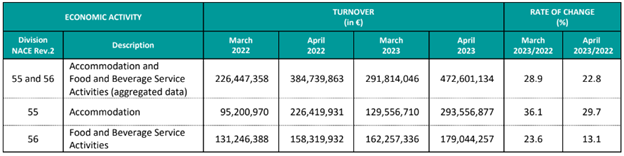

Accommodation and Food and Beverage Service: Turnover increase of 22.8% in April

For the enterprises in Accommodation and Food and Beverage Service Activities, the turnover in April 2023 amounted to 472.601.134 euro, recording an increase of 22.8% in comparison with April 2022, when the respective turnover was 384.739.863 euro. For the Regional Units with a contribution to the total turnover of the year 2022 greater than 1.0% the biggest increase in the turnover of April 2023 compared with April 2022 was recorded in Kerkyra (60.1%) and the smallest increase (7.3%) was recorded in Mykonos.

Source: Hellenic Statistical Authority (ELSTAT)

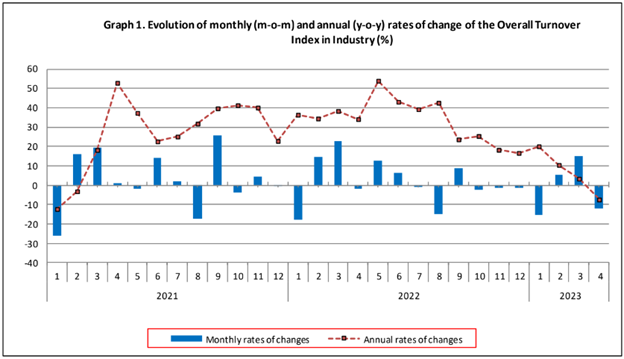

Industry: Y-o-Y turnover decrease of 7.4%

The Overall Turnover Index in Industry (both Domestic and Non-Domestic Market) in April 2023 recorded a decrease of 7.4% compared with the corresponding index of April 2022. The Overall Turnover Index in Industry in April 2022 increased by 34.1% compared with the corresponding index in April 2021. The Overall Turnover Index in Industry in April 2023, compared with March 2023, recorded a decrease of 12.3%. The average Overall Turnover Index in Industry for the 12-month period from May 2022 to April 2023 increased by 22.7%, compared with the corresponding index of the 12-month period from May 2021 to April 2022. The average Overall

Turnover Index in Industry for the 12-month period from May 2021 to April 2022 increased by 33.4% compared with the corresponding index of the 12-month period from May 2020 to April 2021.

Source: Hellenic Statistical Authority (ELSTAT)

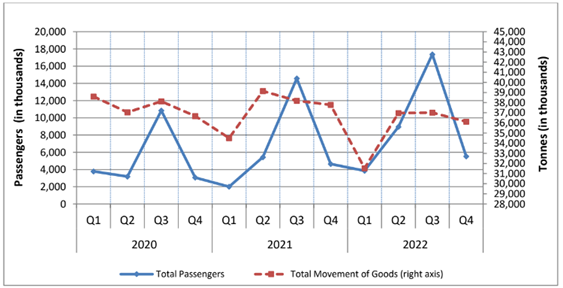

Significant passenger traffic surge in the Greek ports

The total passenger traffic in Greek ports in the 4th quarter 2022 recorded an increase of 19.1% compared with the 4th quarter 2021, while at the corresponding comparison of the 4th quarter of 2021 with the 4th quarter of 2020 an increase by 51.3% was recorded. The total movements of goods in Greek ports in the 4th quarter 2022 decreased by 4.4% compared with the 4th quarter 2021, while at the corresponding comparison of the 4th quarter of 2021 with the

4th quarter of 2020 an increase by 3.0% was recorded.

Source: Hellenic Statistical Authority (ELSTAT)

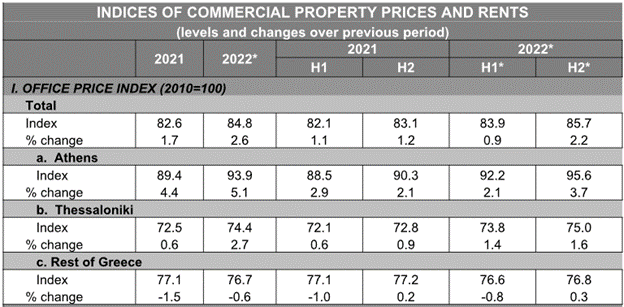

Greek prime office prices increased on average by 2.6%

In 2022 nominal prime office prices for the entire country increased on average by 2.6% relative to 2021, against an increase of 1.7% in 2021. Broken down by region, in 2022 nominal prime office prices increased on average by 5.1% in Athens, 2.7% in Thessaloniki, while they decreased by 0.6% in the rest of Greece. In 2022, nominal office rents of all classes, for the entire country, increased οn average by 1.6% in nominal terms (provisional data). Broken down by region, the corresponding average annual rate of increase in rents was 2.7% in Athens, 5.9% in Thessaloniki, while a decrease of 0.5% was recorded in the rest of Greece.

Source: Bank of Greece

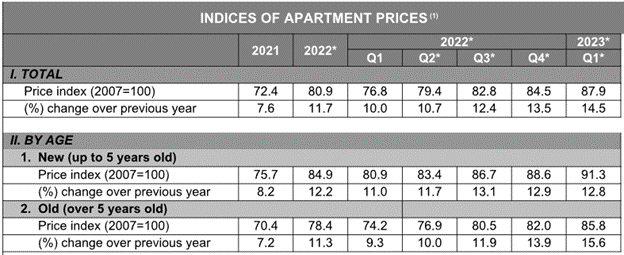

Αpartment prices increased by 14.5%

Αpartment prices are estimated to have increased on average by 14.5% year-on-year in the first quarter of 2023. In 2022, apartment prices increased by an average annual rate of 11.7%, compared with an average increase of 7.6% in 2021. More specifically, in the first quarter of 2023 the year-on-year rate of increase in prices was 12.8% for new apartments (up to 5 years old) and 15.6% for old apartments (over 5 years old). According to revised data, in 2022 prices of new apartments increased on average by 12.2%, against an increase of 8.2% in 2021, whereas prices of old apartments increased by 11.3% in 2022, against an increase of 7.2% in 2021.

Source: Bank of Greece

Τravel services: 498,2 million surplus in April

The balance of travel services in April 2023 showed a surplus of €498.2 million, up from a surplus of €429.2 million in April 2022. More specifically, travel receipts in April 2023 rose by 19.9% to €761.1 million, from €634.9 million in April 2022, while travel payments also increased by 27.8% (April 2023: €262.9 million, April 2022: €205.7 million). The rise in travel receipts was due to a 30.0% increase in inbound traveller flows, as average expenditure per trip declined by 8.4%. Net travel receipts offset 21.9% of the goods deficit and contributed 60.1% to total net services receipts. In January April 2023, the balance of travel services posted a surplus of €731.4 million, up from a surplus of €579.3 million in the same period of 2022. Travel receipts rose by €411.7 million, or 38.0%, to €1,494.0 million, while travel payments increased by €259.5 million, or 51.6%, to €762.6 million. The rise in travel receipts reflected a 52.5% increase in inbound traveller flows, as average expenditure per trip fell by 9.6%. Net travel receipts offset 7.6% of the goods deficit and contributed 40.1% to total net services receipts.

Corporate loans got expensive

In April 2023, the weighted average interest rate on new deposits remained almost unchanged at 0.25%, while the corresponding rate on new loans increased to 5.85%. According to data from the Bank of Greece, the interest rate spread between new deposits and loans increased to 5.60 percentage points. In April 2023, the weighted average interest rate on outstanding amounts of deposits increased to 0.29%, while the corresponding rate on loans increased to 5.84%. The interest rate spread between outstanding amounts of deposits and loans increased to 5.55 percentage points. The average interest rate on new corporate loans without a defined maturity increased by 41 basis points to 6.36%. The corresponding rate on loans to sole proprietors increased by 14 basis points to 7.57%. In April 2023, the average interest rate on new corporate loans with a defined maturity at a floating rate increased by 5 basis points to 5.56%. The average interest rate on loans with a defined maturity at a floating rate to small and medium-sized enterprises (SMEs) increased by 37 basis points to 6.05%.